Вавада казино - вход, регистрация и зеркало

Со дня запуска онлайн казино прошло более шести лет, сейчас Vavada — это топовый клуб для ценителей азарта, который предоставляет услуги согласно лицензии Кюрасао. Каждый посетитель портала видит простое оформление, с яркими акцентами на функциональных кнопках, разделах и игорных автоматах. На странице все выглядит лаконично и удобно в использовании. Незарегистрированные пользователи переходят к созданию аккаунта, нажимая на кнопку «Регистрация». Она занимает центральное место рядом с логотипом бренда, поэтому не заметить опцию невозможно. Рядом расположилась функция входа. Ей пользуются активные клиенты заведения. После авторизации их место занимает чек-бокс доступа в личный кабинет и чат службы поддержки.

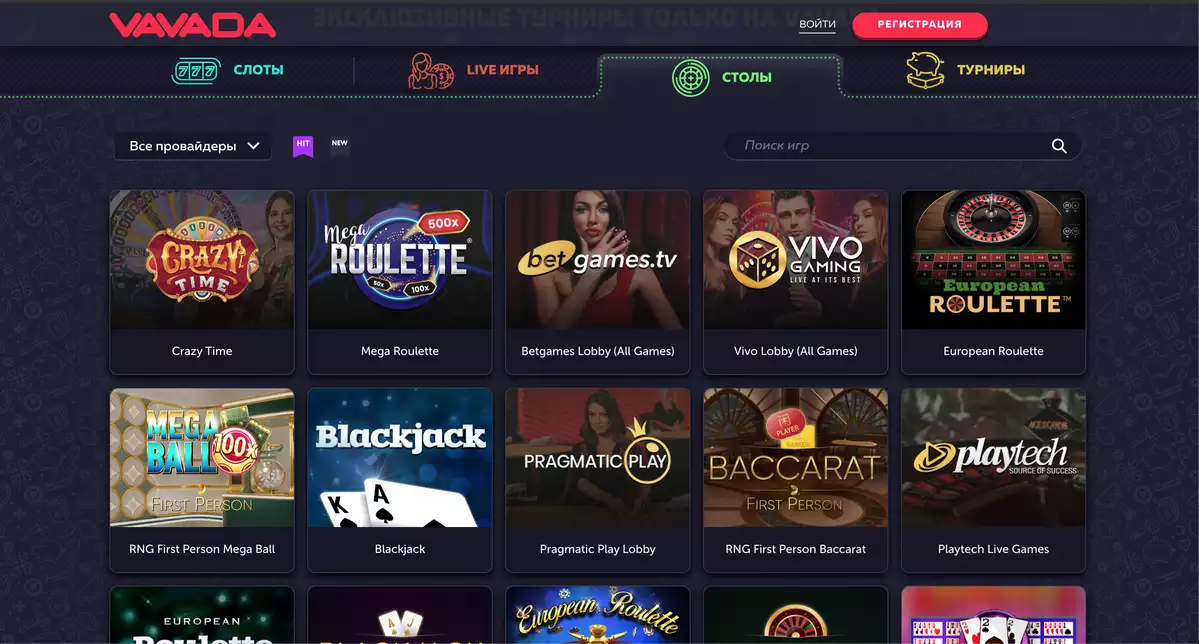

В верхней части страницы выделяется баннер. Он демонстрирует посетителям размеры трех джекпотов, приветственные бонусы Вавада на сегодня и анонс розыгрыша внедорожника марки Мерседес. Под ним в ряд выстроились разделы игротеки. Ее коллекция, которая содержит более 5000 игровых автоматов, разделилась на слоты, столы, лайвы и турниры. Их поставляют 46 провайдеров. Список компаний можно увидеть в окне с левой стороны. Возле находятся флажки фильтры. С их помощью огромный ассортимент разделов квалифицируется по новизне (New) и числу запусков (Hit). Основную часть ресурса занимает игровое лобби. В первых рядах стоят рекомендуемые аппараты, которые отличаются отдачей от 95%, щедрыми множителями и увлекательным процессом игры.

В подвале страницы стоит внимательно прочитать правила казино и ознакомиться с принципами ответственного гемблинга. Открыть лицензионное соглашение или изучить способы оплаты, в число которых входит 17 платежных систем. Если нажать на круглый значок слева экрана, то раскроется перечень языковых версий интерфейса. Кликая на иконки соцсетей, можно перейти в официальные сообщества casino и подписаться.

| 🕹️ Игровая платформа | Вавада |

| 🎯Дата открытия | 13.10.2017 |

| 🎰 Топовые провайдеры | NetEnt, Igrosoft, Novomatic, Betsoft, EGT, Evolution Gaming, Thunderkick, Microgaming, Quickspin |

| 🃏Тип казино | Браузерная, мобильная, live-версии |

| 🍋Операционная система | Android, iOS, Windows |

| 💎Приветственные бонусы | 100 фриспинов + 100% к первому депозиту |

| ⚡Способы регистрации | Через email, телефон, соц. сети |

| 💲Игровые валюты | Рубли, евро, доллары, гривны |

| 💱Минимальная сумма депозита | 50 рублей |

| 💹Минимальная сумма выплаты | 1000 рублей |

| 💳Платёжные инструменты | Visa/MasterCard, SMS, Moneta.ru, Webmoney, Neteller, Skrill |

| 💸Поддерживаемый язык | Русский |

| ☝Круглосуточная служба поддержки | Email, live-чат, телефон |

Какие функции выполняет зеркало Вавада? Официальный вход на портал во время блокировок

Когда официальный сайт заблокирован, пользователи переходят на рабочие зеркальные платформы. Это стандартная практика в странах, где онлайн-казино находятся под запретом законодательства. К таким государствам относится и Россия. Ее гражданам азартный клуб предлагает воспользоваться копией, которая является отражением базового веб-ресурса. Она работает на тех же условиях, с аналогичными сервисными возможностями и игротекой. Это позволяет завсегдатаям восстанавливать допуск к своим аккаунтам, а новичкам — проходить регистрацию и присоединяться к клиентам казино.

Единственное, что отличает дублирующий сайт от основного — это доменный адрес. Чтобы зеркало casino Vavada на сегодняшний день не заблокировали, его URL надежно скрывает принадлежность площадки к игорному заведению. Но такая мера не только служит защитой от блокировки, но и затрудняет поиск рабочей страницы для игроков. Им приходится пользоваться помощью модераторов социальных сетей в Инстраграм, Телеграм и Вк, а также саппорта по электронной почте. Есть и другие способы получения ссылок на зеркала такие, как поиск на форумах, тематических порталах и ресурсах партнеров. Но они сопряжены с риском попасть на подделку мошенников.

Вход на ВавадаКак зарегистрироваться на Вавада: инструкция по шагам

Процесс создания учетной записи на платформе состоит из нескольких действий. После того как будет открыта регистрационная форма, потребуется сделать следующее:

- Указать электронную почту. В последующих авторизациях она станет логином.

- Придумать пароль с надежной комбинацией и ввести ее в пустую строку.

- Выбрать валюту для проведения платежных операций. Этот шаг автоматически открывает депозит.

- Поставить птичку напротив правил и положений конфиденциальности портала, если согласны с ними.

- Завершить регистрацию на сайте Вавада. Для этого необходимо нажать кнопку с соответствующим названием.

Чтобы выполнить еще парочку формальностей, перейдите в пользовательский офис. В его разделе «Профиль» подтвердите указанный имейл и заполните анкетную форму. Ниже вставьте в верификационное окно файл с копиями паспорта. Это процедура не входит в список обязательных, поэтому ее разрешается пропустить. Но она понадобится при получении промокода на День Рождения или по требованию службы безопасности.

Бонусы для Vavada: виды вознаграждений и их условия

В казино вознаграждаются все пользователи. На старте новоприбывшие получают подарки за создание учетной записи, а после за активные ставки, комментарии и лайки в соцсетях. Все поощрения делятся на четыре вида и содержат как бездепозитные опции для ходов в автоматах, так и депозитные бусты.

Лучшие слоты на Вавада

| 🔥 Бездепозитный бонус: | 100 фриспинов |

| 💻 Официальный сайт: | vavada.com |

| 🎲 Тип казино: | Слоты, Столы, Live, Турниры |

| 🗓 Рабочее зеркало: | Есть |

Приветственный бонус за регистрацию

После авторизованного входа на сайт, новичок сразу же получает бездеп в виде 100 вращений для барабана Great Pigsby Magaways. Они доступны к применению в течение 14 дней. Если не использовать фриспины и не отыграть их с коэффициентом х20, то они без следа сгорают. Чтобы прокрутить куш, понадобится пополнить депозит на соответствующую сумму и потратить реальные деньги на любых слотах.

Двойной множитель на депозитный счет

Первый денежный взнос принесет двойной профит, если его сумма будет от 1 до 1000$. Как и бездепозитный бонус, прибавка к игровому балансу действует ограниченный срок — всего 2 недели. За это время деньги потребуется потратить в любых барабанах игротеки, а прибыль прокрутить с вейджером х35.

Промокоды Вавада

Ценные подарки содержат бонусные коды для постоянных клиентов. Те, кто хочет получать промокоды Вавада на депозит с регулярным постоянством, подписываются на рассылку, следят за промоакциями в соцсетях и заходят на стримы блогеров партнеров. Именинники могут за неделю до Дня Рождения отправить запрос в техподдержку. Консультанты пришлют подарок в праздничную дату.

Кэшбек

Поводом для выплаты 10% от потраченных средств становится минусовой баланс игрока по итогам геймплея за тридцатидневный период. Платеж приходит на бонусный счет в первых числах месяца. Если его не начислили, то геймеру повезло выиграть больше, чем он проиграл. Тратить кэшбэк разрешено в любых симуляторах. Чтобы вывести прибыль, потребуется ее отыграть с коэффициентом х5.

Программа лояльности Vavada

К бонусам Вавады гемблеры получают еще ряд привилегий, которые присваиваются пользователю за повышение статуса. Игроки, достигшие бронзового, серебряного, золотого и платинового уровня пользуются такими преимуществами:

- Выводят выигрыши на условиях повышенных лимитов от 1500 до 10000$ в сутки.

- Берут участие в бесплатных соревнованиях с призовыми фондами до 25000$.

- При возникновении затруднений, обращаются за помощью к личным менеджерам.

- Получают большее число вознаграждений без усилий.

Ранговое положение требуется подтверждать каждые 30 дней. Для этого необходимо ежемесячно тратить на ставки от 15 до 50000$.

Приложение для Айфона и устройств Андроид — мобильная версия сайта Vavada

Сегодня нет необходимости как привязанному сидеть у компьютера. Казино в смартфоне обеспечивает доступ к играм в любом месте, где появилась свободная минутка для любимых развлечений. Приложение пользуется теми же функциональными возможностями, что и браузерный вариант платформы и обладает довольно удобным интерфейсом. Его размер и кнопки подстраиваются под диагональ девайса, поэтому навигация, геймплей и использование функций не вызывают затруднений.

На высоком уровне остается и работа автоматов. При подключении к сети интернет слоты, столы и лайвы запускаются без багов. Не стоит переживать и о безопасности личных данных. Программа хорошо защищена от кибератак и воздействия вирусных файлов. Чтобы скачать приложение Вавада, обратитесь в службу поддержки. Операторы вышлют безопасную ссылку.

Список рабочих зеркал Вавада

Игровые автоматы платформы Vavada

На странице веб-ресурса гемблеры чаще всего запускают барабаны. Их игровое поле, которое содержит катушки в несколько рядов, напоминают сетку из секций с символами. Повторяющиеся картинки собираются в выигрышные комбинации и дарят множители к ставке. Любители настолок выбирают виртуальные столы или онлайн трансляции с карточными развлечениями и такими играми, как рулетка, монополия, лото и подобные им. Те, кто предпочитает незамысловатые правила геймплея, по достоинству оценивают краш-симуляторы и аппараты с поисковыми сюжетами. Все они предлагают примерно такие характеристики, как в этих топовых автоматах:

- Extra Chilli Magaways. Входит в подборку «топ слоты Вавада» благодаря отдаче 96,82% и максимальному множителю х20000. Барабан также характеризуется наличием символов замены и нескольких скаттеров, риск-игры и раундов на фриспины.

- Big Bass Crash. Стол с отдачей 95,5% и бесконечным множителем. Ставка может увеличиваться столько, сколько продержится рыболовная сеть. Пока она не порвалась, нужно успеть вывести кэш.

- Crazy Time. Слот входит в раздел live Vavada и проводится в прямом эфире студии компании Evolution. Он предлагает 54 сегмента барабанов, которые дают от х2 до х25000 к ставке. Среди них 4 бонусных раунда: Coin Flip, Cash Hunt, Pachinko и Crazy Time. RTP лайва — 95,5%.

Разнообразие игротеки дополняют турниры. Это соревнования в симуляторах, которые предоставляет администрация. Сражения ведутся в различных форматах. В Икс и Х-плюс турнирах участники играют на деньги и собирают множители, которые определяют их место в турнирной таблице. В Кэш и Фриспин-турнирах соревнующиеся применяют выданные бесплатные фишки и спины. А в МаксБет совсем неважно сколько заносов получится сорвать, потому что победители определяются по суммам ставок.

Размер призов зависит от призового фонда и позиции участника в рейтинге. Капиталы от 20000$ до 65000$ распределяются по убыванию: лидеры рейтинговой таблицы забирают самые крупные призы — до 12000$, аутсайдеры — по 100$. С 25 по 31 декабря суперпризом будет автомобиль Мерседес G-class. Его владельцем станет победитель MaxBet сражения.

Техническая поддержка Вавада

Любой вопрос и затруднение решают консультанты технической поддержки. Они работают круглосуточно и принимают вопросы в онлайн чате веб-площадки или мобильного приложения. Чтобы начать диалог, нужно открыть окно саппорта кликом по кнопке «Помощь» и описать возникшую проблему. Оператор откликнется в течение 20-30 минут. Если чат по каким-то причинам недоступен, игроки обращаются в техподдержку по e-mail или консультируются с администраторами групп в социальных сетях.

Партнерская программа Vavada казино: условия сотрудничества

Если есть желание помочь заведению в продвижении бренда, то на этом веб-мастера и блогеры зарабатывают приличные деньги. Чтобы присоединится к партнерам Вавада потребуется написать в службу поддержки и получить контакты менеджера аффилейта. С ним потенциальный сотрудник оговаривает детали партнерства и при достижении согласия по всем пунктам, подписывает договор. Его условия включают такие основные пункты:

- Оплата на начальном этапе в размере 50% от прибыли клиентского трафика. Если его поток становится стабильно высоким, процент пересматривается в сторону повышения.

- Формирование оплаты по двум системам. За переход гемблера по реферальной ссылке (RevShare) и за выполненное им задание (CPA).

- Начисление заработка 2 раза в месяц.

Партнер после подписания договора пользуется помощью аффилейта и специальным разделом в личном кабинете, где отображается вся информация о начислениях за рефералов.

Способы пополнения и вывода средств

Внести игровые деньги на Вавада и вывести выигранные средства несложно. Нужно войти в кошелек и выбрать соответствующую вкладку. Каждая содержит 17 способов пополнения и извлечения валюты. Среди этих методов есть карты банковских учреждений, е-кошельки и криптовалютные сервисы. В их число входят МастерКард и Виза, Card to crypto и Card by crypto, Bitcoin, Ethereum, Tether, Litecoin, SEPA, YouWallet, Piastrix и другие. Для пополнения минимальная сумма составляет 1$, чтобы вывести средства с депозитного баланса потребуется минимум 20$. Транзакции выполняются за считанные минуты и без взимания комиссий.

Официальный сайт казино ВавадаFAQ

Как зайти на Вавада в России?

Рекомендуем установить приложение на телефон или компьютер. На программу не действуют ограничения интернет-провайдеров. Ссылку на скачивание запросите в чате саппорта.

Как активировать промокод в casino Vavada?

Откройте персональный офис вкладку с бонусами. В правой части экрана находится авторизационное окно. Вставьте в его поле промокод и кликните по кнопке с надписью «Активировать».

Как удалить аккаунт Вавада?

Приостановить или деактивировать действие учетной записи могут только специалисты технической поддержки. Обратитесь к ним с этой просьбой, а затем подтвердите свой логин (e-mail).

Отзывы

-

Лайк за интересные игры, возможность выигрывать кэш и выводить его без задержек. Плюс в копилку за отсутствие требования верифицироваться.

-

Считаю Ваваду суперским сайтом для игр. Лояльнее условий сложно придумать, развлечений куча… Жаль только букмекерских ставок нет. Было бы совсем круто.

-

Всем, кто сомневается в сервисе казино, перестаньте. Регистрируйтесь и наслаждайтесь качественным гемблингом.

-

Мое пребывание на Vavada уже принесло профит. А я здесь без года неделю, поэтому рада, что попала на сайт.

-

Есть и достоинства и недостатки, но то что мне не по нраву другим заходит. Не судите по отзывам, получайте собственный опыт.